UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): April 27, 2021

(Exact name of Registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||||||||||||

(Address of principal executive offices)

(972 ) 349-6200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On April 27, 2021, Veritex Holdings, Inc. (the “Company”), the holding company for Veritex Community Bank (the “Bank”), a Texas state chartered bank, issued a press release describing its results of operations for the quarter ended March 31, 2021. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

As provided in General Instruction B.2 to Form 8-K, the information furnished in this Item 2.02 (including Exhibit 99.1) of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On Wednesday, April 28, 2021 at 8:30 a.m., Central Time, the Company will host an investor conference call and webcast to review its first quarter financial results. The webcast will include a slide presentation that consists of information regarding the Company’s operating and growth strategies and financial performance. The presentation materials will be posted on the Company’s website on April 27, 2021. The presentation materials are attached hereto as Exhibit 99.2 and are incorporated herein by reference.

As provided in General Instruction B.2 to Form 8-K, the information furnished in this Item 7.01 (including Exhibit 99.2) of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events

On April 27, 2021, the Company issued a press release announcing the declaration of a quarterly cash dividend of $0.17 per share on its outstanding common stock. The dividend will be paid on or after May 20, 2021 to shareholders of record as of the close of business on May 6, 2021. The press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

On April 27, 2021, the Company issued a press release announcing the execution by the Bank of a definitive agreement pursuant to which the Bank will acquire a 49% interest in Thrive Mortgage, LLC ("Thrive") for $53.9 million in cash. Upon completion of the investment, the Company will obtain the right to designate a member to Thrive’s board of directors. The investment, which is expected to close in the middle of 2021, is subject to receipt of required regulatory approvals and other customary closing conditions. The press release is attached hereto as Exhibit 99.4 and is incorporated herein by reference.

Forward Looking Statement

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on various facts and derived utilizing assumptions, current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include, without limitation, statements relating to the anticipated closing of the Company’s investment in Thrive, the expected payment date of the Company’s quarterly cash dividend, the impact of certain changes in the Company’s accounting policies, standards and interpretations, the effects of the COVID-19 pandemic and actions taken in response thereto, the Company’s future financial performance, business and growth strategy, projected plans and objectives, as well as other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and any updates to those risk factors set forth in the Company’s Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange

Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, actual results may differ materially from what the Company anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. The Company does not undertake any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, expressed or implied, included in this Current Report are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that the Company or persons acting on the Company’s behalf may issue.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| Exhibit Number | Description | |||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. | |||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Veritex Holdings, Inc. | ||||||||

| By: | /s/ C. Malcolm Holland, III | |||||||

| C. Malcolm Holland, III | ||||||||

| Chairman and Chief Executive Officer | ||||||||

| Date: | April 27, 2021 | |||||||

Exhibit 99.1

VERITEX HOLDINGS, INC. REPORTS FIRST QUARTER OPERATING RESULTS

Dallas, TX — April 27, 2021 —Veritex Holdings, Inc. (“Veritex” or the “Company”) (Nasdaq: VBTX), the holding company for Veritex Community Bank, today announced the results for the quarter ended March 31, 2021.

“We are very pleased with our operating results for the first quarter of 2021. Our business momentum continues to build as a result of our investments in talent and the accelerated reopening of the Texas economy,” said C. Malcolm Holland, III, the Company’s Chairman and Chief Executive Officer. “Our loan and deposit growth remains good, credit trends are improving and our balance sheet it strong. We couldn’t be more excited about the future of Veritex including today’s announcement of our partnership with Thrive Mortgage.”

First Quarter Highlights

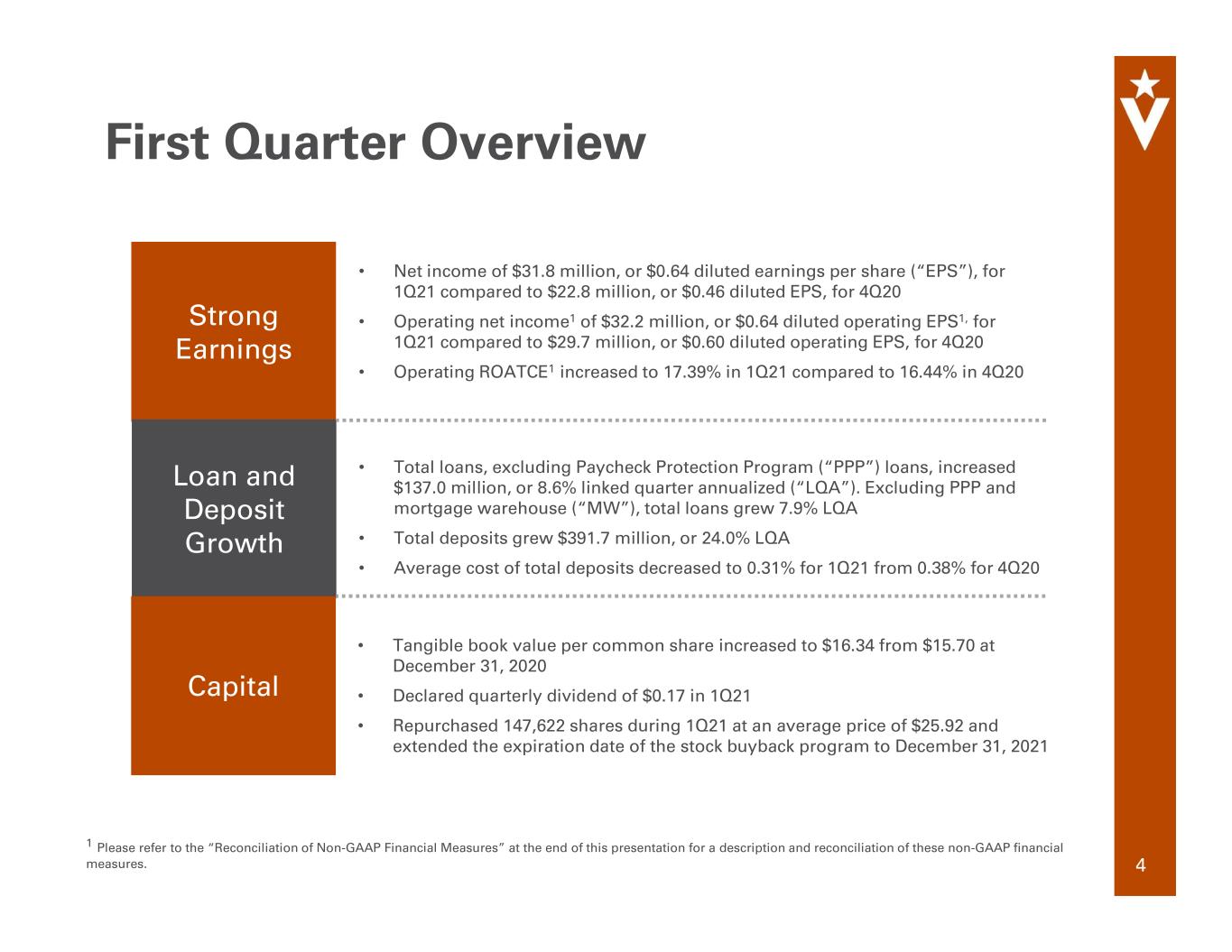

•Net income of $31.8 million, or $0.64 diluted earnings per share (“EPS”), compared to $22.8 million, or $0.46 diluted EPS, for the quarter ended December 31, 2020 and $4.1 million, or $0.08 diluted EPS, for the quarter ended March 31, 2020;

•Pre-tax, pre-provision operating earnings1 totaled $40.2 million, compared to $38.4 million for the quarter ended December 31, 2020 and $39.1 million for the quarter ended March 31, 2020;

•Operating return on average tangible common equity1 of 17.39% for the three months ended March 31, 2021 compared to 16.44% for the three months ended December 31, 2020;

•Total loans held for investment, excluding PPP loans, grew $137.0 million from the fourth quarter of 2020, or 8.65% annualized. Total loans held for investment, excluding PPP loans, grew $337.6 million, or 5.42%, year over year;

•Total deposits grew $391.7 million from the fourth quarter of 2020, or 24.0% annualized, with the average cost of total deposits decreasing to 0.31% for the three months ended March 31, 2021 from 0.38% and 1.02% for the three months ended December 31, 2020 and March 31, 2020, respectively;

•Declared quarterly cash dividend of $0.17 payable on May 20, 2021;

•Extended the expiration date of the stock buyback program to December 31, 2021.

| Financial Highlights | Q1 2021 | Q4 2020 | ||||||||||||

| (Dollars in thousands) (unaudited) | ||||||||||||||

| GAAP | ||||||||||||||

| Net income | $ | 31,787 | $ | 22,801 | ||||||||||

| Diluted EPS | 0.64 | 0.46 | ||||||||||||

| Book value per common share | 24.96 | 24.39 | ||||||||||||

Return on average assets2 | 1.44 | % | 1.04 | % | ||||||||||

| Efficiency ratio | 49.62 | 62.52 | ||||||||||||

Non-GAAP1 | ||||||||||||||

| Operating earnings | $ | 32,213 | $ | 29,730 | ||||||||||

| Diluted operating EPS | 0.64 | 0.60 | ||||||||||||

| Tangible book value per common share | 16.34 | 15.70 | ||||||||||||

| Pre-tax, pre-provision operating earnings | 40,210 | 38,407 | ||||||||||||

Pre-tax, pre-provision operating return on average assets2 | 1.82 | % | 1.75 | % | ||||||||||

Operating return on average assets2 | 1.46 | 1.35 | ||||||||||||

| Operating efficiency ratio | 49.62 | 49.49 | ||||||||||||

| Return on average tangible common equity | 17.17 | 12.84 | ||||||||||||

| Operating return on average tangible common equity | 17.39 | 16.44 | ||||||||||||

1 Refer to the section titled “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of these non-generally accepted accounting principles (“”GAAP”) financial measures to their most directly comparable GAAP measures.

2 Annualized ratio.

1

Results of Operations for the Three Months Ended March 31, 2021

Net Interest Income

For the three months ended March 31, 2021, net interest income before provision for credit losses was $65.6 million and net interest margin was 3.22% compared to $66.8 million and 3.29%, respectively, for the three months ended December 31, 2020. Net interest margin decreased 7 basis point from the three months ended December 31, 2020 primarily due to a decrease in the average yields earned on loans slightly offset by the average rates paid on interest-bearing demand and savings deposits and certificate and other time deposits for the three months ended March 31, 2021. As a result, the average cost of interest-bearing deposits decreased 10 basis points to 0.45% for the three months ended March 31, 2021 from 0.55% for the three months ended December 31, 2020.

Net interest income before provision for credit losses decreased by $1.8 million from $67.4 million to $65.6 million and net interest margin decreased by 45 basis points from 3.67% to 3.22% for the three months ended March 31, 2021 as compared to the same period in 2020. The decrease in net interest income before provision for credit losses was primarily due to a $10.5 million decrease in interest income on loans and a $1.2 million increase in interest expense on subordinated debentures and subordinated notes, partially offset by $4.6 million and $5.2 million decrease in interest expenses on transaction and savings deposits and certificates and other time deposits, respectively, during the three months ended March 31, 2021 compared to the three months ended March 31, 2020. Net interest margin decreased 45 basis points from the three months ended March 31, 2020 primarily due to a decrease in yields earned on loan balances, partially offset by decreases in the average rate paid on interest-bearing demand and savings deposits and certificates and other time deposits for the three months ended March 31, 2021. As a result, the average cost of interest-bearing deposits decreased 92 basis points to 0.45% for the three months ended March 31, 2021 from 1.37% for the three months ended March 31, 2020.

Noninterest Income

Noninterest income for the three months ended March 31, 2021 was $14.2 million, an increase of $5.2 million, or 57.3%, compared to the three months ended December 31, 2020. The increase was primarily due to a $6.1 million increase in government guaranteed loan income, net, driven by $6.6 million of fee income earned on PPP loans during the three months ended March 31, 2021 with no corresponding fee income earned on PPP loans earned during the three months ended December 31, 2020. This was partially offset by a $1.5 million decrease in derivative income.

Compared to the three months ended March 31, 2020, noninterest income for the three months ended March 31, 2021 increased by $6.9 million, or 95.6%. The increase was primarily due to a $6.1 million increase in government guaranteed loan income, net, as a result of the fee income earned on PPP loans for the three months ended March 31, 2021 with no corresponding fee income earned on PPP loans during the three months ended March 31, 2020.

Noninterest Expense

Noninterest expense was $39.6 million for the three months ended March 31, 2021, compared to $47.4 million for the three months ended December 31, 2020, a decrease of $7.8 million, or 16.4%. The decrease was primarily driven by a $9.7 million decrease in debt extinguishment costs on Federal Home Loan Bank ("FHLB") advances that were pre-paid during the three months ended December 31, 2020 with no corresponding FHLB advance prepayments during the three months ended March 31, 2021. This decrease was partially offset by a $2.9 million increase in salaries and employee benefits primarily driven by a $980 thousand decrease in deferred origination costs, a $515 thousand increase in FICA taxes and a $331 thousand increase in employee stock based compensation.

Compared to the three months ended March 31, 2020, noninterest expense for the three months ended March 31, 2021 increased by $4.1 million, or 11.4%. The increase was primarily driven by a $4.1 million increase in salaries and employee benefits as a result of a $1.9 million increase in accrued bonus, a $1.2 million increase in lender incentive and a $487 thousand increase in employee stock based compensation.

2

Financial Condition

Total loans were $7.0 billion at March 31, 2021, an increase of $184.8 million, or 10.9% annualized, compared to December 31, 2020. The increase was the result of the continued execution and success of our loan growth strategy.

Total deposits were $6.9 billion at March 31, 2021, an increase of $391.7 million, or 24.0% annualized, compared to December 31, 2020. The increase was primarily the result of increases of $231.2 million in interest-bearing transaction and savings deposits, $85.9 million in certificates and other time deposits, and $74.6 million in noninterest-bearing demand deposits.

Asset Quality

Nonperforming assets totaled $85.0 million, or 0.92% of total assets at March 31, 2021, compared to $87.6 million, or 0.99% of total assets, at December 31, 2020. Included in nonperforming assets is $9.1 million of accruing loans 90 or more days past due that are considered well-secured and in the process of collection. Excluding accruing loans 90 or more days past due, nonperforming assets represented 0.82% of total assets at March 31, 2021, a 13 basis point decrease compared to December 31, 2020. The Company’s net charge-offs for the three months ended March 31, 2021 were nominal.

The Company recorded no provision for credit losses for the three months ended March 31, 2021 and December 31, 2020, compared to $31.8 million for the three months ended March 31, 2020. The decrease in the recorded provision for credit losses for the three months ended March 31, 2021, compared to the three months ended March 31, 2020, was primarily attributable to improvement in the Texas economic forecasts used in the Current Expected Credit Losses (“CECL”) model in the first quarter of 2021 to reflect the expected impact of the COVID-19 pandemic as of March 31, 2021, as compared to our Texas economic forecasts and expected impact of the COVID-19 pandemic as of March 31, 2020. In the first quarter of 2021, we also recorded a $570 thousand recovery in our provision for unfunded commitments which was attributable to improvement in the Texas economic forecasts compared to a $902 thousand provision for unfunded commitments recorded for the three months ended December 31, 2020. Allowance for credit losses as a percentage of LHI, excluding MW and PPP loans, was 1.76%, 1.80% and 1.73% at March 31, 2021, December 31, 2020 and March 31, 2020, respectively.

Dividend Information

On April 27, 2021, Veritex’s Board of Directors declared a quarterly cash dividend of $0.17 per share on its outstanding shares of common stock. The dividend will be paid on or after May 20, 2021 to stockholders of record as of the close of business on May 6, 2021.

Non-GAAP Financial Measures

Veritex’s management uses certain non-GAAP (U.S. generally accepted accounting principles) financial measures to evaluate its operating performance and provide information that is important to investors. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with GAAP. Specifically, Veritex reviews and reports tangible book value per common share, operating earnings, tangible common equity to tangible assets, return on average tangible common equity, pre-tax, pre-provision operating earnings, pre-tax, pre-provision operating return on average assets, diluted operating earnings per share, operating return on average assets, operating return on average tangible common equity and operating efficiency ratio. Veritex has included in this earnings release information related to these non-GAAP financial measures for the applicable periods presented. Please refer to “Reconciliation of Non-GAAP Financial Measures” after the financial highlights at the end of this earnings release for a reconciliation of these non-GAAP financial measures.

Conference Call

The Company will host an investor conference call to review the results on Tuesday, April 27, 2021 at 8:30 a.m. Central Time. Participants may pre-register for the call by visiting https://edge.media-server.com/mmc/p/vz2jxi3a and will receive a unique PIN, which can be used when dialing in for the call. This will allow attendees to access the call immediately. Alternatively, participants may call toll-free at (877) 703-9880.

The call and corresponding presentation slides will be webcast live on the home page of the Company's website, https://ir.veritexbank.com/. An audio replay will be available one hour after the conclusion of the call at (855) 859-2056, Conference

#4978885. This replay, as well as the webcast, will be available until May 4, 2021.

3

About Veritex Holdings, Inc.

Headquartered in Dallas, Texas, Veritex is a bank holding company that conducts banking activities through its wholly owned subsidiary, Veritex Community Bank, with locations throughout the Dallas-Fort Worth metroplex and in the Houston metropolitan area. Veritex Community Bank is a Texas state chartered bank regulated by the Texas Department of Banking and the Board of Governors of the Federal Reserve System. For more information, visit www.veritexbank.com.

Media and Investor Relations:

investorrelations@veritexbank.com

Forward-Looking Statements

This earnings release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on various facts and derived utilizing assumptions, current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements include, without limitation, statements relating to the expected payment date of Veritex’s quarterly cash dividend, the impact of certain changes in Veritex’s accounting policies, standards and interpretations, the effects of the COVID-19 pandemic and actions taken in response thereto, Veritex’s future financial performance, business and growth strategy, projected plans and objectives, as well as other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Veritex’s Annual Report on Form 10-K for the year ended December 31, 2020 and any updates to those risk factors set forth in Veritex’s Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Veritex does not undertake any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, expressed or implied, included in this earnings release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Veritex or persons acting on Veritex’s behalf may issue.

4

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(Unaudited)

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars and shares in thousands) | ||||||||||||||||||||||||||||||||

| Per Share Data (Common Stock): | ||||||||||||||||||||||||||||||||

| Basic EPS | $ | 0.64 | $ | 0.46 | $ | 0.46 | $ | 0.48 | $ | 0.08 | ||||||||||||||||||||||

| Diluted EPS | 0.64 | 0.46 | 0.46 | 0.48 | 0.08 | |||||||||||||||||||||||||||

| Book value per common share | 24.96 | 24.39 | 23.87 | 23.45 | 23.19 | |||||||||||||||||||||||||||

Tangible book value per common share1 | 16.34 | 15.70 | 15.19 | 14.71 | 14.39 | |||||||||||||||||||||||||||

| Common Stock Data: | ||||||||||||||||||||||||||||||||

| Shares outstanding at period end | 49,433 | 49,340 | 49,650 | 49,633 | 49,557 | |||||||||||||||||||||||||||

| Weighted average basic shares outstanding for the period | 49,394 | 49,571 | 49,647 | 49,597 | 50,725 | |||||||||||||||||||||||||||

| Weighted average diluted shares outstanding for the period | 49,998 | 49,837 | 49,775 | 49,727 | 51,056 | |||||||||||||||||||||||||||

| Summary of Credit Ratios: | ||||||||||||||||||||||||||||||||

| ACL to total LHI, excluding mortgage warehouse and PPP loans | 1.76 | % | 1.80 | % | 2.10 | % | 2.01 | % | 1.73 | % | ||||||||||||||||||||||

| Nonperforming assets to total assets | 0.92 | 0.99 | 1.11 | 0.62 | 0.60 | |||||||||||||||||||||||||||

| Net charge-offs to average loans outstanding | — | 0.28 | 0.04 | 0.03 | — | |||||||||||||||||||||||||||

| Summary Performance Ratios: | ||||||||||||||||||||||||||||||||

Return on average assets2 | 1.44 | 1.04 | 1.06 | 1.11 | 0.20 | |||||||||||||||||||||||||||

Return on average equity2 | 10.53 | 7.58 | 7.74 | 8.36 | 1.41 | |||||||||||||||||||||||||||

Return on average tangible common equity1, 2 | 17.17 | 12.84 | 13.27 | 14.49 | 3.27 | |||||||||||||||||||||||||||

| Efficiency ratio | 49.62 | 62.52 | 48.12 | 46.02 | 47.61 | |||||||||||||||||||||||||||

| Selected Performance Metrics - Operating: | ||||||||||||||||||||||||||||||||

Diluted operating EPS1 | $ | 0.64 | $ | 0.60 | $ | 0.46 | $ | 0.43 | $ | 0.08 | ||||||||||||||||||||||

Pre-tax, pre-provision operating return on average assets1, 2 | 1.82 | % | 1.75 | % | 1.82 | % | 2.11 | % | 1.94 | % | ||||||||||||||||||||||

Operating return on average assets1, 2 | 1.46 | 1.35 | 1.06 | 0.98 | 0.20 | |||||||||||||||||||||||||||

Operating return on average tangible common equity1, 2 | 17.39 | 16.44 | 13.27 | 12.90 | 3.27 | |||||||||||||||||||||||||||

Operating efficiency ratio1 | 49.62 | 49.49 | 48.11 | 45.74 | 47.61 | |||||||||||||||||||||||||||

| Veritex Holdings, Inc. Capital Ratios: | ||||||||||||||||||||||||||||||||

| Tier 1 capital to average assets (leverage) | 9.50 | 9.43 | 9.54 | 9.16 | 9.49 | |||||||||||||||||||||||||||

| Common equity tier 1 capital | 9.27 | 9.30 | 9.67 | 9.66 | 9.53 | |||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 9.61 | 9.66 | 10.05 | 10.05 | 9.92 | |||||||||||||||||||||||||||

| Total capital to risk-weighted assets | 13.38 | 13.56 | 12.70 | 12.71 | 12.48 | |||||||||||||||||||||||||||

Tangible common equity to tangible assets1 | 9.17 | 9.23 | 9.12 | 8.96 | 8.81 | |||||||||||||||||||||||||||

1Refer to the section titled “Reconciliation of Non-GAAP Financial Measures” after the financial highlights for a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP measures.

2Annualized ratio for quarterly metrics.

5

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(In thousands)

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 468,029 | $ | 230,825 | $ | 128,767 | $ | 160,306 | $ | 430,842 | ||||||||||||||||||||||

| Debt securities | 1,077,860 | 1,055,201 | 1,091,440 | 1,112,061 | 1,117,804 | |||||||||||||||||||||||||||

| Other investments | 87,226 | 87,192 | 98,023 | 104,213 | 112,775 | |||||||||||||||||||||||||||

| Loans held for sale | 19,864 | 21,414 | 13,928 | 28,041 | 15,048 | |||||||||||||||||||||||||||

| Loans held for investment, Paycheck Protection Program (“PPP”) loans, carried at fair value | 407,353 | 358,042 | 405,465 | 398,949 | — | |||||||||||||||||||||||||||

| Loans held for investment, mortgage warehouse (“MW”) | 599,001 | 577,594 | 544,845 | 441,992 | 371,161 | |||||||||||||||||||||||||||

| Loans held for investment, excluding MW and PPP | 5,963,493 | 5,847,862 | 5,789,293 | 5,726,873 | 5,853,735 | |||||||||||||||||||||||||||

| Total loans | 6,989,711 | 6,804,912 | 6,753,531 | 6,595,855 | 6,239,944 | |||||||||||||||||||||||||||

| Allowance for credit losses (“ACL”) | (104,936) | (105,084) | (121,591) | (115,365) | (100,983) | |||||||||||||||||||||||||||

| Bank-owned life insurance | 83,318 | 82,855 | 82,366 | 81,876 | 81,395 | |||||||||||||||||||||||||||

| Bank premises, furniture and equipment, net | 114,585 | 115,063 | 115,794 | 115,560 | 116,056 | |||||||||||||||||||||||||||

| Other real estate owned (“OREO”) | 2,337 | 2,337 | 5,796 | 7,716 | 7,720 | |||||||||||||||||||||||||||

| Intangible assets, net of accumulated amortization | 59,236 | 61,733 | 64,716 | 66,705 | 69,444 | |||||||||||||||||||||||||||

| Goodwill | 370,840 | 370,840 | 370,840 | 370,840 | 370,840 | |||||||||||||||||||||||||||

| Other assets | 89,304 | 114,997 | 112,693 | 88,091 | 85,787 | |||||||||||||||||||||||||||

| Total assets | $ | 9,237,510 | $ | 8,820,871 | $ | 8,702,375 | $ | 8,587,858 | $ | 8,531,624 | ||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | $ | 2,171,719 | $ | 2,097,099 | $ | 1,920,715 | $ | 1,907,697 | $ | 1,549,260 | ||||||||||||||||||||||

| Interest-bearing transaction and savings deposits | 3,189,693 | 2,958,456 | 2,821,945 | 2,714,149 | 2,536,865 | |||||||||||||||||||||||||||

| Certificates and other time deposits | 1,543,158 | 1,457,291 | 1,479,896 | 1,503,701 | 1,713,820 | |||||||||||||||||||||||||||

| Total deposits | 6,904,570 | 6,512,846 | 6,222,556 | 6,125,547 | 5,799,945 | |||||||||||||||||||||||||||

| Accounts payable and other liabilities | 55,902 | 61,928 | 69,540 | 68,713 | 61,746 | |||||||||||||||||||||||||||

| Advances from Federal Home Loan Bank | 777,679 | 777,718 | 1,082,756 | 1,087,794 | 1,377,832 | |||||||||||||||||||||||||||

| Subordinated debentures and subordinated notes | 262,774 | 262,778 | 140,158 | 140,283 | 140,406 | |||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 2,777 | 2,225 | 2,028 | 1,772 | 2,426 | |||||||||||||||||||||||||||

| Total liabilities | 8,003,702 | 7,617,495 | 7,517,038 | 7,424,109 | 7,382,355 | |||||||||||||||||||||||||||

| Commitments and contingencies | ||||||||||||||||||||||||||||||||

| Stockholders’ equity: | ||||||||||||||||||||||||||||||||

| Common stock | 557 | 555 | 555 | 555 | 554 | |||||||||||||||||||||||||||

| Additional paid-in capital | 1,131,324 | 1,126,437 | 1,124,148 | 1,122,063 | 1,119,757 | |||||||||||||||||||||||||||

| Retained earnings | 195,661 | 172,232 | 157,639 | 143,277 | 127,812 | |||||||||||||||||||||||||||

| Accumulated other comprehensive income | 62,413 | 56,225 | 47,155 | 42,014 | 45,306 | |||||||||||||||||||||||||||

Treasury stock | (156,147) | (152,073) | (144,160) | (144,160) | (144,160) | |||||||||||||||||||||||||||

| Total stockholders’ equity | 1,233,808 | 1,203,376 | 1,185,337 | 1,163,749 | 1,149,269 | |||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 9,237,510 | $ | 8,820,871 | $ | 8,702,375 | $ | 8,587,858 | $ | 8,531,624 | ||||||||||||||||||||||

6

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(In thousands, except per share data)

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 67,399 | $ | 69,597 | $ | 68,685 | $ | 70,440 | $ | 77,861 | ||||||||||||||||||||||

| Debt securities | 7,437 | 7,652 | 7,852 | 7,825 | 7,397 | |||||||||||||||||||||||||||

| Deposits in financial institutions and Fed Funds sold | 127 | 99 | 65 | 186 | 871 | |||||||||||||||||||||||||||

| Equity securities and other investments | 663 | 752 | 827 | 891 | 850 | |||||||||||||||||||||||||||

| Total interest income | 75,626 | 78,100 | 77,429 | 79,342 | 86,979 | |||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||

| Transaction and savings deposits | 1,980 | 2,105 | 2,105 | 2,471 | 6,552 | |||||||||||||||||||||||||||

| Certificates and other time deposits | 3,061 | 3,919 | 5,004 | 6,515 | 8,240 | |||||||||||||||||||||||||||

| Advances from FHLB | 1,812 | 2,222 | 2,707 | 2,801 | 2,879 | |||||||||||||||||||||||||||

| Subordinated debentures and subordinated notes | 3,138 | 3,088 | 1,743 | 1,798 | 1,903 | |||||||||||||||||||||||||||

| Total interest expense | 9,991 | 11,334 | 11,559 | 13,585 | 19,574 | |||||||||||||||||||||||||||

| Net interest income | 65,635 | 66,766 | 65,870 | 65,757 | 67,405 | |||||||||||||||||||||||||||

| Provision for credit losses | — | — | 8,692 | 16,172 | 31,776 | |||||||||||||||||||||||||||

| (Benefit) provision for unfunded commitments | (570) | 902 | 1,447 | 2,799 | 3,881 | |||||||||||||||||||||||||||

| Net interest income after provisions | 66,205 | 65,864 | 55,731 | 46,786 | 31,748 | |||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||

| Service charges and fees on deposit accounts | 3,629 | 3,971 | 3,130 | 2,960 | 3,642 | |||||||||||||||||||||||||||

| Loan fees | 1,341 | 684 | 1,787 | 1,240 | 845 | |||||||||||||||||||||||||||

| (Loss) gain on sales of investment securities | — | (256) | (8) | 2,879 | — | |||||||||||||||||||||||||||

| Gain on sales of mortgage loans held for sale | 507 | 317 | 472 | 308 | 142 | |||||||||||||||||||||||||||

| Government guaranteed loan income, net | 6,548 | 448 | 2,257 | 11,006 | 439 | |||||||||||||||||||||||||||

| Other | 2,147 | 3,848 | 2,157 | 2,897 | 2,014 | |||||||||||||||||||||||||||

| Total noninterest income | 14,172 | 9,012 | 9,795 | 21,290 | 7,247 | |||||||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 22,932 | 20,011 | 20,553 | 20,019 | 18,870 | |||||||||||||||||||||||||||

| Occupancy and equipment | 4,096 | 4,116 | 3,980 | 3,994 | 4,273 | |||||||||||||||||||||||||||

| Professional and regulatory fees | 3,441 | 3,578 | 3,159 | 2,796 | 2,196 | |||||||||||||||||||||||||||

| Data processing and software expense | 2,319 | 2,238 | 2,452 | 2,434 | 2,089 | |||||||||||||||||||||||||||

| Marketing | 909 | 945 | 1,062 | 561 | 1,083 | |||||||||||||||||||||||||||

| Amortization of intangibles | 2,537 | 2,558 | 2,840 | 2,696 | 2,696 | |||||||||||||||||||||||||||

| Telephone and communications | 337 | 340 | 345 | 308 | 319 | |||||||||||||||||||||||||||

| COVID expenses | — | — | 132 | 1,245 | — | |||||||||||||||||||||||||||

| Debt extinguishment costs | — | 9,746 | — | 1,561 | — | |||||||||||||||||||||||||||

| Other | 3,026 | 3,841 | 1,885 | 4,447 | 4,019 | |||||||||||||||||||||||||||

| Total noninterest expense | 39,597 | 47,373 | 36,408 | 40,061 | 35,545 | |||||||||||||||||||||||||||

| Income before income tax expense | 40,780 | 27,503 | 29,118 | 28,015 | 3,450 | |||||||||||||||||||||||||||

| Income tax expense (benefit) | 8,993 | 4,702 | 6,198 | 3,987 | (684) | |||||||||||||||||||||||||||

| Net income | $ | 31,787 | $ | 22,801 | $ | 22,920 | $ | 24,028 | $ | 4,134 | ||||||||||||||||||||||

| Basic EPS | $ | 0.64 | $ | 0.46 | $ | 0.46 | $ | 0.48 | $ | 0.08 | ||||||||||||||||||||||

| Diluted EPS | $ | 0.64 | $ | 0.46 | $ | 0.46 | $ | 0.48 | $ | 0.08 | ||||||||||||||||||||||

| Weighted average basic shares outstanding | 49,394 | 49,571 | 49,647 | 49,597 | 50,725 | |||||||||||||||||||||||||||

| Weighted average diluted shares outstanding | 49,998 | 49,837 | 49,775 | 49,727 | 51,056 | |||||||||||||||||||||||||||

7

````````````````````````````````````VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(In thousands except percentages)

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | March 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Outstanding Balance | Interest Earned/ Interest Paid | Average Yield/ Rate | Average Outstanding Balance | Interest Earned/ Interest Paid | Average Yield/ Rate | Average Outstanding Balance | Interest Earned/ Interest Paid | Average Yield/ Rate | ||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans1 | $ | 5,897,815 | $ | 62,702 | 4.31 | % | $ | 5,798,692 | $ | 65,259 | 4.48 | % | $ | 5,784,965 | $ | 76,527 | 5.32 | % | ||||||||||||||||||||||||||||||||||||||

| Loans held for investment, MW | 510,678 | 3,815 | 3.03 | 446,027 | 3,355 | 2.99 | 163,646 | 1,334 | 3.28 | |||||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 356,356 | 882 | 1.00 | 390,509 | 983 | 1.00 | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities | 1,063,538 | 7,437 | 2.84 | 1,076,031 | 7,652 | 2.83 | 1,038,954 | 7,397 | 2.86 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits in other banks | 341,483 | 127 | 0.15 | 258,687 | 99 | 0.15 | 308,546 | 871 | 1.14 | |||||||||||||||||||||||||||||||||||||||||||||||

| Equity securities and other investments | 87,178 | 663 | 3.08 | 95,706 | 752 | 3.13 | 91,917 | 850 | 3.72 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 8,257,048 | 75,626 | 3.71 | 8,065,652 | 78,100 | 3.85 | 7,388,028 | 86,979 | 4.74 | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (105,972) | (121,162) | (44,270) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 790,195 | 805,651 | 782,024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 8,941,271 | $ | 8,750,141 | $ | 8,125,782 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Stockholders’ Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand and savings deposits | $ | 3,038,586 | $ | 1,980 | 0.26 | % | $ | 2,862,084 | $ | 2,105 | 0.29 | % | $ | 2,638,633 | $ | 6,552 | 1.00 | % | ||||||||||||||||||||||||||||||||||||||

| Certificates and other time deposits | 1,509,836 | 3,061 | 0.82 | 1,467,250 | 3,919 | 1.06 | 1,650,678 | 8,240 | 2.01 | |||||||||||||||||||||||||||||||||||||||||||||||

| Advances from FHLB | 777,694 | 1,812 | 0.94 | 885,014 | 2,222 | 1.00 | 937,901 | 2,879 | 1.23 | |||||||||||||||||||||||||||||||||||||||||||||||

| Subordinated debentures and subordinated notes | 265,356 | 3,138 | 4.80 | 259,581 | 3,088 | 4.73 | 145,189 | 1,903 | 5.27 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 5,591,472 | 9,991 | 0.72 | 5,473,929 | 11,334 | 0.82 | 5,372,401 | 19,574 | 1.47 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 2,069,233 | 2,011,995 | 1,523,702 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 56,272 | 67,943 | 46,563 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 7,716,977 | 7,553,867 | 6,942,666 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 1,224,294 | 1,196,274 | 1,183,116 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity | $ | 8,941,271 | $ | 8,750,141 | $ | 8,125,782 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest rate spread2 | 2.99 | % | 3.03 | % | 3.27 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 65,635 | $ | 66,766 | $ | 67,405 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin3 | 3.22 | % | 3.29 | % | 3.67 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

1 Includes average outstanding balances of loans held for sale of $16,602, $11,938 and $10,995 for the three months ended March 31, 2021, December 31, 2020, and March 31, 2020, respectively, and average balances of loans held for investment, excluding mortgage warehouse and PPP loans.

2 Net interest rate spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities.

3 Net interest margin is equal to net interest income divided by average interest-earning assets.

8

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

Yield Trend

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | ||||||||||||||||||||||||||||

| Average yield on interest-earning assets: | ||||||||||||||||||||||||||||||||

Loans1 | 4.31 | % | 4.48 | % | 4.49 | % | 4.68 | % | 5.32 | % | ||||||||||||||||||||||

| Loans held for investment, MW | 3.03 | 2.99 | 3.00 | 3.01 | 3.28 | |||||||||||||||||||||||||||

| PPP loans | 1.00 | 1.00 | 1.00 | 1.00 | — | |||||||||||||||||||||||||||

| Debt securities | 2.84 | 2.83 | 2.84 | 2.82 | 2.86 | |||||||||||||||||||||||||||

| Interest-bearing deposits in other banks | 0.15 | 0.15 | 0.15 | 0.20 | 1.14 | |||||||||||||||||||||||||||

| Equity securities and other investments | 3.08 | 3.13 | 3.17 | 3.24 | 3.72 | |||||||||||||||||||||||||||

| Total interest-earning assets | 3.71 | % | 3.85 | % | 3.90 | % | 3.99 | % | 4.74 | % | ||||||||||||||||||||||

| Average rate on interest-bearing liabilities: | ||||||||||||||||||||||||||||||||

| Interest-bearing demand and savings deposits | 0.26 | % | 0.29 | % | 0.31 | % | 0.37 | % | 1.00 | % | ||||||||||||||||||||||

| Certificates and other time deposits | 0.82 | 1.06 | 1.36 | 1.61 | 2.01 | |||||||||||||||||||||||||||

| Advances from FHLB | 0.94 | 1.00 | 1.01 | 0.93 | 1.23 | |||||||||||||||||||||||||||

| Subordinated debentures and subordinated notes | 4.80 | 4.73 | 4.87 | 5.07 | 5.27 | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 0.72 | % | 0.82 | % | 0.85 | % | 0.97 | % | 1.47 | % | ||||||||||||||||||||||

Net interest rate spread2 | 2.99 | % | 3.03 | % | 3.05 | % | 3.02 | % | 3.27 | % | ||||||||||||||||||||||

Net interest margin3 | 3.22 | % | 3.29 | % | 3.32 | % | 3.31 | % | 3.67 | % | ||||||||||||||||||||||

1Includes average outstanding balances of loans held for sale of $16,602, $11,938, $15,404, $22,958 and $10,995 for the three months ended March 31, 2021, December 31, 2020, September 30, 2020, June 30, 2020 and March 31, 2020, respectively, and average balances of loans held for investment, excluding mortgage warehouse and PPP loans.

2 Net interest rate spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities.

3 Net interest margin is equal to net interest income divided by average interest-earning assets.

Supplemental Yield Trend

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | ||||||||||||||||||||||||||||

| Average cost of interest-bearing deposits | 0.45 | % | 0.55 | % | 0.67 | % | 0.84 | % | 1.37 | % | ||||||||||||||||||||||

| Average costs of total deposits, including noninterest-bearing | 0.31 | 0.38 | 0.46 | 0.59 | 1.02 | |||||||||||||||||||||||||||

9

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(In thousands except percentages)

Total LHI and Deposit Portfolio Composition

| March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | March 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LHI1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 1,632,040 | 27.4 | % | $ | 1,559,546 | 26.7 | % | $ | 1,623,249 | 28.0 | % | $ | 1,555,300 | 27.2 | % | $ | 1,777,603 | 30.4 | % | ||||||||||||||||||||||||||||||||||||||||||

| Real Estate: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owner occupied commercial | 733,310 | 12.3 | 717,472 | 12.3 | 734,939 | 12.7 | 769,952 | 13.4 | 723,839 | 12.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial | 1,970,945 | 33.0 | 1,904,132 | 32.5 | 1,817,013 | 31.4 | 1,847,480 | 32.3 | 1,828,386 | 31.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Construction and land | 723,444 | 12.1 | 693,030 | 11.8 | 623,496 | 10.8 | 599,510 | 10.5 | 566,470 | 9.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Farmland | 14,751 | 0.2 | 13,844 | 0.2 | 14,413 | 0.2 | 14,723 | 0.3 | 14,930 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1-4 family residential | 492,609 | 8.3 | 524,344 | 9.0 | 548,953 | 9.5 | 528,688 | 9.2 | 536,892 | 9.2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Multi-family residential | 386,844 | 6.5 | 424,962 | 7.3 | 412,412 | 7.1 | 394,829 | 6.8 | 388,374 | 6.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 12,431 | 0.2 | 13,000 | 0.2 | 14,127 | 0.1 | 14,932 | 0.3 | 15,771 | 0.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total LHI | $ | 5,966,374 | 100 | % | $ | 5,850,330 | 100 | % | $ | 5,788,602 | 100 | % | $ | 5,725,414 | 100 | % | $ | 5,852,265 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||

| MW | 599,001 | 577,594 | 544,845 | 441,992 | 373,161 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 407,353 | 358,042 | 405,465 | 398,949 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total LHI1 | $ | 6,972,728 | $ | 6,785,966 | $ | 6,738,912 | $ | 6,566,355 | $ | 6,225,426 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing | $ | 2,171,719 | 31.6 | % | $ | 2,097,099 | 32.3 | % | $ | 1,920,715 | 30.9 | % | $ | 1,907,697 | 31.1 | % | $ | 1,549,260 | 26.7 | % | ||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction | 463,343 | 6.7 | 453,110 | 7.0 | 450,739 | 7.2 | 343,640 | 5.6 | 306,641 | 5.3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money market | 2,602,903 | 37.7 | 2,398,526 | 36.8 | 2,267,191 | 36.4 | 2,272,520 | 37.1 | 2,143,874 | 37.0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | 123,447 | 1.8 | 106,820 | 1.6 | 104,015 | 1.7 | 97,989 | 1.6 | 86,350 | 1.5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Certificates and other time deposits | 1,543,158 | 22.2 | 1,457,291 | 22.4 | 1,479,896 | 23.7 | 1,503,701 | 24.5 | 1,713,820 | 29.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits | $ | 6,904,570 | 100 | % | $ | 6,512,846 | 100 | % | $ | 6,222,556 | 100 | % | $ | 6,125,547 | 100 | % | $ | 5,799,945 | 100 | % | ||||||||||||||||||||||||||||||||||||||||||

| Loan to Deposit Ratio | 101.0 | % | 104.2 | % | 108.3 | % | 107.2 | % | 107.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan to Deposit Ratio, excluding MW and PPP loans | 86.4 | % | 89.8 | % | 93.0 | % | 93.5 | % | 100.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

1 Total LHI does not include deferred fees of $2.9 million, $2.5 million, and $691 thousand at March 31, 2021, December 31, 2020 and September 30, 2020, respectively, deferred costs of $1.5 million and $1.5 million at June 30, 2020 and March 31, 2020, respectively.

10

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Financial Highlights

(In thousands except percentages)

Asset Quality

| For the Three Months Ended | |||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Nonperforming Assets (“NPAs”): | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 73,594 | $ | 81,096 | $ | 88,877 | $ | 43,594 | $ | 38,836 | |||||||||||||||||||

Accruing loans 90 or more days past due1 | 9,093 | 4,204 | 1,689 | 2,021 | 4,764 | ||||||||||||||||||||||||

| Total nonperforming loans held for investment (“NPLs”) | 82,687 | 85,300 | 90,566 | 45,615 | 43,600 | ||||||||||||||||||||||||

| OREO | 2,337 | 2,337 | 5,796 | 7,716 | 7,720 | ||||||||||||||||||||||||

| Total NPAs | $ | 85,024 | $ | 87,637 | $ | 96,362 | $ | 53,331 | $ | 51,320 | |||||||||||||||||||

| Charge-offs: | |||||||||||||||||||||||||||||

| Residential | $ | (15) | $ | (18) | $ | — | $ | — | $ | — | |||||||||||||||||||

| Owner occupied commercial real estate | — | — | (2,421) | — | — | ||||||||||||||||||||||||

| Nonowner occupied commercial real estate | — | (2,865) | — | — | — | ||||||||||||||||||||||||

| Commercial | (346) | (13,699) | (68) | (1,740) | — | ||||||||||||||||||||||||

| Consumer | (18) | (26) | (11) | (57) | (68) | ||||||||||||||||||||||||

| Total charge-offs | (379) | (16,608) | (2,500) | (1,797) | (68) | ||||||||||||||||||||||||

| Recoveries: | |||||||||||||||||||||||||||||

| Residential | 3 | 49 | 7 | — | 1 | ||||||||||||||||||||||||

| Commercial | 226 | 52 | 14 | 7 | 29 | ||||||||||||||||||||||||

| Consumer | 2 | — | 13 | — | 274 | ||||||||||||||||||||||||

| Total recoveries | 231 | 101 | 34 | 7 | 304 | ||||||||||||||||||||||||

| Net charge-offs | $ | (148) | $ | (16,507) | $ | (2,466) | $ | (1,790) | $ | 236 | |||||||||||||||||||

| CECL transition adjustment | $ | — | $ | — | $ | — | $ | — | $ | 39,137 | |||||||||||||||||||

| Allowance for credit losses (“ACL”) at end of period | $ | 104,936 | $ | 105,084 | $ | 121,591 | $ | 115,365 | $ | 100,983 | |||||||||||||||||||

| Asset Quality Ratios: | |||||||||||||||||||||||||||||

| NPAs to total assets | 0.92 | % | 0.99 | % | 1.11 | % | 0.62 | % | 0.60 | % | |||||||||||||||||||

| NPLs to total LHI, excluding MW and PPP loans | 1.39 | 1.46 | 1.56 | 0.80 | 0.75 | ||||||||||||||||||||||||

| ACL to total LHI, excluding MW and PPP loans | 1.76 | 1.80 | 2.10 | 2.01 | 1.73 | ||||||||||||||||||||||||

| Net charge-offs to average loans outstanding | — | 0.28 | 0.04 | 0.03 | — | ||||||||||||||||||||||||

1 Accruing loans greater than 90 days past due exclude purchase credit deteriorated loans greater than 90 days past due that are accounted for on a pooled basis.

11

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

We identify certain financial measures discussed in this earnings release as being “non-GAAP financial measures.” In accordance with SEC rules, we classify a financial measure as being a non-GAAP financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are included or excluded, as the case may be, in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles as in effect from time to time in the United States (“GAAP”), in our statements of income, balance sheets or statements of cash flows. Non-GAAP financial measures do not include operating and other statistical measures or ratios calculated using exclusively either one or both of (i) financial measures calculated in accordance with GAAP and (ii) operating measures or other measures that are not non-GAAP financial measures.

The non-GAAP financial measures that we present in this earnings release should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate the non-GAAP financial measures that we present in this earnings release may differ from that of other companies reporting measures with similar names. You should understand how such other financial institutions calculate their financial measures that appear to be similar or have similar names to the non-GAAP financial measures we have discussed in this earnings release when comparing such non-GAAP financial measures.

Tangible Book Value Per Common Share. Tangible book value is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. We calculate: (a) tangible common equity as total stockholders’ equity less goodwill and core deposit intangibles, net of accumulated amortization; and (b) tangible book value per common share as tangible common equity (as described in clause (a)) divided by number of common shares outstanding. For tangible book value per common share, the most directly comparable financial measure calculated in accordance with GAAP is book value per common share.

We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in core deposit intangibles. Goodwill and other intangible assets have the effect of increasing total book value while not increasing our tangible book value.

The following table reconciles, as of the dates set forth below, total stockholders’ equity to tangible common equity and presents our tangible book value per common share compared with our book value per common share:

| As of | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||||||||||||||

| Tangible Common Equity | ||||||||||||||||||||||||||||||||

| Total stockholders' equity | $ | 1,233,808 | $ | 1,203,376 | $ | 1,185,337 | $ | 1,163,749 | $ | 1,149,269 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (370,840) | (370,840) | (370,840) | (370,840) | (370,840) | |||||||||||||||||||||||||||

| Core deposit intangibles | (55,311) | (57,758) | (60,209) | (62,661) | (65,112) | |||||||||||||||||||||||||||

| Tangible common equity | $ | 807,657 | $ | 774,778 | $ | 754,288 | $ | 730,248 | $ | 713,317 | ||||||||||||||||||||||

| Common shares outstanding | 49,433 | 49,340 | 49,650 | 49,633 | 49,557 | |||||||||||||||||||||||||||

| Book value per common share | $ | 24.96 | $ | 24.39 | $ | 23.87 | $ | 23.45 | $ | 23.19 | ||||||||||||||||||||||

| Tangible book value per common share | $ | 16.34 | $ | 15.70 | $ | 15.19 | $ | 14.71 | $ | 14.39 | ||||||||||||||||||||||

12

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

Tangible Common Equity to Tangible Assets. Tangible common equity to tangible assets is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. We calculate: (a) tangible common equity as total stockholders’ equity, less goodwill and core deposit intangibles, net of accumulated amortization; (b) tangible assets as total assets less goodwill and core deposit intangibles, net of accumulated amortization; and (c) tangible common equity to tangible assets as tangible common equity (as described in clause (a)) divided by tangible assets (as described in clause (b)). For tangible common equity to tangible assets, the most directly comparable financial measure calculated in accordance with GAAP is total stockholders’ equity to total assets.

We believe that this measure is important to many investors in the marketplace who are interested in the relative changes from period to period in common equity and total assets, in each case, exclusive of changes in core deposit intangibles. Goodwill and other intangible assets have the effect of increasing both total stockholders’ equity and assets while not increasing our tangible common equity or tangible assets.

The following table reconciles, as of the dates set forth below, total stockholders’ equity to tangible common equity and total assets to tangible assets and presents our tangible common equity to tangible assets:

| As of | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||

| Tangible Common Equity | ||||||||||||||||||||||||||||||||

| Total stockholders' equity | $ | 1,233,808 | $ | 1,203,376 | $ | 1,185,337 | $ | 1,163,749 | $ | 1,149,269 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (370,840) | (370,840) | (370,840) | (370,840) | (370,840) | |||||||||||||||||||||||||||

| Core deposit intangibles | (55,311) | (57,758) | (60,209) | (62,661) | (65,112) | |||||||||||||||||||||||||||

| Tangible common equity | $ | 807,657 | $ | 774,778 | $ | 754,288 | $ | 730,248 | $ | 713,317 | ||||||||||||||||||||||

| Tangible Assets | ||||||||||||||||||||||||||||||||

| Total assets | $ | 9,237,510 | $ | 8,820,871 | $ | 8,702,375 | $ | 8,587,858 | $ | 8,531,624 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Goodwill | (370,840) | (370,840) | (370,840) | (370,840) | (370,840) | |||||||||||||||||||||||||||

| Core deposit intangibles | (55,311) | (57,758) | (60,209) | (62,661) | (65,112) | |||||||||||||||||||||||||||

| Tangible Assets | $ | 8,811,359 | $ | 8,392,273 | $ | 8,271,326 | $ | 8,154,357 | $ | 8,095,672 | ||||||||||||||||||||||

| Tangible Common Equity to Tangible Assets | 9.17 | % | 9.23 | % | 9.12 | % | 8.96 | % | 8.81 | % | ||||||||||||||||||||||

13

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

Return on Average Tangible Common Equity. Return on average tangible common equity is a non-GAAP measure generally used by financial analysts and investment bankers to evaluate financial institutions. We calculate: (a) net income available for common stockholders adjusted for amortization of core deposit intangibles (which we refer to as “return”) as net income, plus amortization of core deposit intangibles, less tax benefit at the statutory rate; (b) average tangible common equity as total average stockholders’ equity less average goodwill and average core deposit intangibles, net of accumulated amortization; and (c) return (as described in clause (a)) divided by average tangible common equity (as described in clause (b)). For return on average tangible common equity, the most directly comparable financial measure calculated in accordance with GAAP is return on average equity.

We believe that this measure is important to many investors in the marketplace who are interested in the return on common equity, exclusive of the impact of core deposit intangibles. Goodwill and core deposit intangibles have the effect of increasing total stockholders’ equity while not increasing our tangible common equity. This measure is particularly relevant to acquisitive institutions that may have higher balances in goodwill and core deposit intangibles than non-acquisitive institutions.

The following table reconciles, as of the dates set forth below, average tangible common equity to average common equity and net income available for common stockholders adjusted for amortization of core deposit intangibles, net of taxes to net income and presents our return on average tangible common equity:

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||

| Net income available for common stockholders adjusted for amortization of core deposit intangibles | ||||||||||||||||||||||||||||||||

| Net income | $ | 31,787 | $ | 22,801 | $ | 22,920 | $ | 24,028 | $ | 4,134 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Plus: Amortization of core deposit intangibles | 2,447 | 2,451 | 2,451 | 2,451 | 2,451 | |||||||||||||||||||||||||||

| Less: Tax benefit at the statutory rate | 514 | 515 | 515 | 515 | 515 | |||||||||||||||||||||||||||

| Net income available for common stockholders adjusted for amortization of core deposit intangibles | $ | 33,720 | $ | 24,737 | $ | 24,856 | $ | 25,964 | $ | 6,070 | ||||||||||||||||||||||

| Average Tangible Common Equity | ||||||||||||||||||||||||||||||||

| Total average stockholders' equity | $ | 1,224,294 | $ | 1,196,274 | $ | 1,177,882 | $ | 1,155,798 | $ | 1,183,116 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Average goodwill | (370,840) | (370,840) | (370,840) | (370,840) | (370,840) | |||||||||||||||||||||||||||

| Average core deposit intangibles | (56,913) | (59,010) | (61,666) | (64,151) | (66,439) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 796,541 | $ | 766,424 | $ | 745,376 | $ | 720,807 | $ | 745,837 | ||||||||||||||||||||||

| Return on Average Tangible Common Equity (Annualized) | 17.17 | % | 12.84 | % | 13.27 | % | 14.49 | % | 3.27 | % | ||||||||||||||||||||||

14

VERITEX HOLDINGS, INC. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

Operating Earnings, Pre-tax, Pre-provision Operating Earnings and performance metrics calculated using Operating Earnings and Pre-tax, Pre-provision Operating Earnings, including Diluted Operating Earnings per Share, Operating Return on Average Assets, Pre-tax, Pre-Provision Operating Return on Average Assets, Operating Return on Average Tangible Common Equity and Operating Efficiency Ratio. Operating earnings, pre-tax, pre-provision operating earnings and the performance metrics calculated using these metrics, listed below, are non-GAAP measures used by management to evaluate the Company’s financial performance. We calculate (a) operating earnings as net income plus loss (gain) on sale of securities, net, plus loss (gain) on sale of disposed branch assets, plus FHLB pre-payment fees, plus merger and acquisition expenses, less tax impact of adjustments, plus other merger and acquisition tax items, plus re-measurement of deferred tax assets as a result of the reduction in the corporate income tax rate under the Tax Cuts and Jobs Act. We calculate (b) diluted operating earnings per share as operating earnings as described in clause (a) divided by weighted average diluted shares outstanding. We calculate (c) pre-tax, pre-provision operating earnings as operating earnings as described in clause (a) plus provision for income taxes, plus provision for loan losses. We calculate (d) pre-tax, pre-provision operating return on average assets as pre-tax, pre-provision operating earnings as described in clause (a) divided by average total assets. We calculate (e) operating return on average assets as operating earnings as described in clause (a) divided by average total assets. We calculate (f) operating return on average tangible common equity as operating earnings as described in clause (a), adjusted for the amortization of intangibles and tax benefit at the statutory rate, divided by total average tangible common equity (average stockholders’ equity less average goodwill and average core deposit intangibles, net of accumulated amortization). We calculate (g) operating efficiency ratio as non interest expense plus adjustments to operating non interest expense divided by (i) non interest income plus adjustments to operating non interest income plus (ii) net interest income.

We believe that these measures and the operating metrics calculated utilizing these measures are important to management and many investors in the marketplace who are interested in understanding the ongoing operating performance of the Company and provide meaningful comparisons to its peers.

The following tables reconcile, as of the dates set forth below, operating net income and pre-tax, pre-provision operating earnings and related metrics:

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||

| Operating Earnings | ||||||||||||||||||||||||||||||||

| Net income | $ | 31,787 | $ | 22,801 | $ | 22,920 | $ | 24,028 | $ | 4,134 | ||||||||||||||||||||||

| Plus: Loss (gain) on sale of securities available for sale, net | — | 256 | 8 | (2,879) | — | |||||||||||||||||||||||||||

Plus: Debt extinguishment costs1 | — | 9,746 | — | 1,561 | — | |||||||||||||||||||||||||||

Operating pre-tax income | 31,787 | 32,803 | 22,928 | 22,710 | 4,134 | |||||||||||||||||||||||||||

| Less: Tax impact of adjustments | — | 2,100 | — | (277) | — | |||||||||||||||||||||||||||

Plus: Nonrecurring tax adjustments2 | 426 | (973) | — | (1,799) | — | |||||||||||||||||||||||||||

| Operating earnings | $ | 32,213 | $ | 29,730 | $ | 22,928 | $ | 21,188 | $ | 4,134 | ||||||||||||||||||||||

| Weighted average diluted shares outstanding | 49,998 | 49,837 | 49,775 | 49,727 | 51,056 | |||||||||||||||||||||||||||

| Diluted EPS | $ | 0.64 | $ | 0.46 | $ | 0.46 | $ | 0.48 | $ | 0.08 | ||||||||||||||||||||||

| Diluted operating EPS | 0.64 | 0.60 | 0.46 | 0.43 | 0.08 | |||||||||||||||||||||||||||

1 Debt extinguishment costs relate to prepayment penalties paid in connection with the early payoff of FHLB structured advances.

2 A nonrecurring tax adjustment of $426 thousand recorded in the first quarter of 2021 was due to a true-up of a deferred tax liability. A nonrecurring tax adjustment of $973 thousand recorded in the fourth quarter of 2020 was primarily due the reversal of acquired deferred tax liabilities resulting in a tax benefit of $1.2 million offset by tax expense of $281 thousand for the setup of an uncertain tax position liability relating to state tax exposure for tax years prior to the year ending December 31, 2020. A nonrecurring tax adjustment of $1,799 was recorded in the second quarter of 2020 as a result of the Company amending a prior year Green tax return to carry back a net operating loss ("NOL") incurred by Green on January 1, 2019. The Company was allowed to carry back this NOL as result of a provision in the CARES Act which permits NOLs generated in tax years 2018, 2019 or 2020 to be carried back five years.

15

| For the Three Months Ended | ||||||||||||||||||||||||||||||||

| Mar 31, 2021 | Dec 31, 2020 | Sep 30, 2020 | Jun 30, 2020 | Mar 31, 2020 | ||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||

| Pre-Tax, Pre-Provision Operating Earnings | ||||||||||||||||||||||||||||||||

| Net income | $ | 31,787 | $ | 22,801 | $ | 22,920 | $ | 24,028 | $ | 4,134 | ||||||||||||||||||||||

| Plus: Provision (benefit) for income taxes | 8,993 | 4,702 | 6,198 | 3,987 | (684) | |||||||||||||||||||||||||||

| Pus: (Benefit) provision for credit losses and unfunded commitments | (570) | 902 | 10,139 | 18,971 | 35,657 | |||||||||||||||||||||||||||

| Plus: Loss (gain) on sale of securities, net | — | 256 | 8 | (2,879) | — | |||||||||||||||||||||||||||

| Plus: Merger and acquisition expenses | — | — | — | — | — | |||||||||||||||||||||||||||

| Pre-tax, pre-provision operating earnings | $ | 40,210 | $ | 38,407 | $ | 39,265 | $ | 45,668 | $ | 39,107 | ||||||||||||||||||||||

| Average total assets | $ | 8,941,271 | $ | 8,750,141 | $ | 8,585,926 | $ | 8,689,774 | $ | 8,125,782 | ||||||||||||||||||||||

Pre-tax, pre-provision operating return on average assets1 | 1.82 | % | 1.75 | % | 1.82 | % | 2.11 | % | 1.94 | % | ||||||||||||||||||||||

| Average total assets | $ | 8,941,271 | $ | 8,750,141 | $ | 8,585,926 | $ | 8,689,774 | $ | 8,125,782 | ||||||||||||||||||||||

Return on average assets1 | 1.44 | % | 1.04 | % | 1.06 | % | 1.11 | % | 0.20 | % | ||||||||||||||||||||||

Operating return on average assets1 | 1.46 | 1.35 | 1.06 | 0.98 | 0.20 | |||||||||||||||||||||||||||

| Operating earnings adjusted for amortization of core deposit intangibles | ||||||||||||||||||||||||||||||||

| Operating earnings | $ | 32,213 | $ | 29,730 | $ | 22,928 | $ | 21,188 | $ | 4,134 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Plus: Amortization of core deposit intangibles | 2,447 | 2,451 | 2,451 | 2,451 | 2,451 | |||||||||||||||||||||||||||

| Less: Tax benefit at the statutory rate | 514 | 515 | 515 | 515 | 515 | |||||||||||||||||||||||||||

| Operating earnings adjusted for amortization of core deposit intangibles | $ | 34,146 | $ | 31,666 | $ | 24,864 | $ | 23,124 | $ | 6,070 | ||||||||||||||||||||||

| Average Tangible Common Equity | ||||||||||||||||||||||||||||||||

| Total average stockholders' equity | $ | 1,224,294 | $ | 1,196,274 | $ | 1,177,882 | $ | 1,155,798 | $ | 1,183,116 | ||||||||||||||||||||||

| Adjustments: | ||||||||||||||||||||||||||||||||

| Less: Average goodwill | (370,840) | (370,840) | (370,840) | (370,840) | (370,840) | |||||||||||||||||||||||||||

| Less: Average core deposit intangibles | (56,913) | (59,010) | (61,666) | (64,151) | (66,439) | |||||||||||||||||||||||||||

| Average tangible common equity | $ | 796,541 | $ | 766,424 | $ | 745,376 | $ | 720,807 | $ | 745,837 | ||||||||||||||||||||||

Operating return on average tangible common equity1 | 17.39 | % | 16.44 | % | 13.27 | % | 12.90 | % | 3.27 | % | ||||||||||||||||||||||

| Efficiency ratio | 49.62 | % | 62.52 | % | 48.12 | % | 46.02 | % | 47.61 | % | ||||||||||||||||||||||

| Operating efficiency ratio | 49.62 | % | 49.49 | % | 48.11 | % | 45.74 | % | 47.61 | % | ||||||||||||||||||||||

1 Annualized ratio.

16

1st Quarter Earnings Conference Call April 28, 2021 Veritex Holdings, Inc.

2 Safe Harbor Statement Forward-looking statements This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on various facts and derived utilizing assumptions, current expectations, estimates and projections and are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Forward- looking statements include, without limitation, statements relating to Veritex Holdings, Inc. (“Veritex”) investment in Thrive Mortgage, the expected payment date of Veritex’s quarterly cash dividend, impact of certain changes in Veritex’s accounting policies, standards and interpretations, the effects of the COVID-19 pandemic and actions taken in response thereto, Veritex’s future financial performance, business and growth strategy, projected plans and objectives, as well as other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Veritex’s Annual Report on Form 10-K for the year ended December 31, 2020 and any updates to those risk factors set forth in Veritex’s Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Veritex does not undertake any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Veritex or persons acting on Veritex’s behalf may issue. This presentation also includes industry and trade association data, forecasts and information that Veritex has prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information publicly available to Veritex, which information may be specific to particular markets or geographic locations. Some data is also based on Veritex's good faith estimates, which are derived from management's knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Although Veritex believes these sources are reliable, Veritex has not independently verified the information contained therein. While Veritex is not aware of any misstatements regarding the industry data presented in this presentation, Veritex's estimates involve risks and uncertainties and are subject to change based on various factors. Similarly, Veritex believes that its internal research is reliable, even though such research has not been verified by independent sources.

3 Non-GAAP Financial Measures Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain supplemental non-GAAP financial measures used in managing its business provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to assess the Company’s operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Veritex’s results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: • Tangible book value per common share; • Tangible common equity to tangible assets; • Return on average tangible common equity (“ROTCE”); • Operating net income; • Pre-tax, pre-provision (“PTPP”) operating earnings; • Diluted operating earnings per share (“EPS”); • Operating return on average assets (“ROAA”); • PTPP operating ROAA; • Operating ROTCE; • Operating efficiency ratio; • Operating noninterest income; • Operating noninterest expense; and • Adjusted net interest margin (“NIM”). Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP.